tax shelter meaning in real estate

Find your basis by taking the total cost of the asset and subtracting the value of the land. A term used to describe some tax advantages of owning real property or other investments.

How Is A Tax Shelter Calculated In Real Estate

A 401k account is a tax shelter.

:max_bytes(150000):strip_icc()/simple-ways-invest-real-estate-4222736-V1-0ac75f2185ba4d7d89ceb63468926659.png)

. The tax shelter portion of home equity occurs in the event that the individual at some point decides to sell their home. Tax shelters vary in terms of real estate investments or investment acco. Shelters range from employer-sponsored 401 k programs to overseas bank accounts.

The phrase tax shelter is often used as a pejorative term but a tax shelter can be a legal way to reduce tax liabilities. AK Alaska Real Estate Exam Prep. Someone who thinks a feature of the tax code giving taxpayers the ability to reduce taxes is.

Divide your basis by 139th. 448a3 prohibition defines tax shelter at Sec. A tax shelter is a method used by businesses and individuals to reduce their tax liabilities.

The tax shelter portion of home equity occurs in the event that the individual at some point decides to sell their home. However its not a permanent one. 448d3 which states that the term tax shelter has the meaning given such term by section 461i3 Sec.

In 2022 employees can make up to 20500 in deductible contributions to a 401 k with workers age 50 and older entitled to deduct an additional 6500 in catch-up contributions. Tax shelters include both investments and investment accounts that provide favorable tax treatment as well as deductions as laid out by the Internal Revenue Service IRS. Depreciation deductions also can be taken for residential rentals in service after 1986 and multi.

A tax shelter is a means of minimizing tax liability. ˈshel-tər Used in a Sentence. A tax shelter is defined differently under various Code sections with one of the broadest definitions used in this case.

A tax shelter is a financial technique used by taxpayers to reduce taxable income. The Internal Revenue Service IRS offers individuals a capital gains tax exemption on the first 250000 from the sale of their home. CA California Real Estate Exam Prep.

Tax shelters work by reducing your taxable income thereby reducing your taxes. Tax shelters are any method of reducing taxable income resulting in a reduction of the payments to tax collecting entities including state and federal governments. For example there are several retirement plans available for any individual to opt for that help reduce tax liabilities.

CT Connecticut Real Estate Exam Prep. The IRS defines a qualified retirement account QRA as an account that meets certain requirements such as. Pick a state where youre taking your Real Estate Exam.

The most common tax shelter is through such retirement accounts. The most widely used tax shelter in the US is the 401k. To be a tax shelter the investment has to lose money.

DE Delaware Real Estate Exam Prep. AL Alabama Real Estate Exam Prep. Tax Shelter Real Estate Definition.

An investment is a tax shelter when it shields income or gain from payment of income taxes. A tax shelter is a place to legally store assets so that current or future tax liabilities are minimized. CrowdStreet - 185 Average IRR from Real Estate Accredited Investors Only Fundrise - 23 Returns Last Year from Real Estate - Get Started with Just.

Tax shelter meaning in real estate Monday July 4 2022 Edit. The methodology can vary depending on local and international tax laws. Our Top Picks Best Money-Making Tips.

When it comes to rentals it is easy to lose money especially if the rental income does not cover the mortgage you have several repair bills among other things. AR Arkansas Real Estate Exam Prep. Tax shelters are ways individuals and corporations reduce their tax liability.

A tax shelter is a legal way of investing in certain plans or schemes that reduce the overall taxable income of the taxpayers and therefore save the taxes that are paid to the state or federal governments. Tax-sheltered assets include qualified retirement accounts certain insurance products partnerships municipal bonds and real estate investment trusts. View the definition of Tax Shelter and preview the CENTURY 21 glossary of popular real estate terminology to help along your buying or selling process.

A tax shelter can be defined as a financial vehicle used by taxpayers or organisations to bring down their taxable income. AZ Arizona Real Estate Exam Prep. 461i3 provides that the term tax shelter.

A general term used to include any property which gives the owner certain income tax advantages such as deductions for property taxes maintenance mortgage interest insurance and especially depreciation. An investment that shields items of income or gain from payment of income taxes Pronunciation. What Is A Credit Shelter Trust Our Deer Estate Law Estate Planning Estate Tax Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021 155.

Tax shelters can be both legal illegal. CO Colorado Real Estate Exam Prep. Heres how to figure your depreciation deduction for commercial properties.

Real Estate Definition - Tax Shelter. Thats your annual depreciation deduction.

Income Tax Calculation For Professional Cricketer 1 5 Cr Husband And Wife Income Tax Budgeting Income

Housing Shortage And Low Interest Rates Are Driving Up House Prices Raboresearch

The Sales Proceeds Calculation Home Mortgage Real Estate Investing Rental Property

How To Save Capital Gain Tax On Sale Of Residential Property

How To Decide If A Property Is A Good Investment The Washington Post

How To Pay No Taxes With Real Estate Investing Youtube

How You Can Make Money From Your Rental Show A Loss On Your Tax Return Semi Retired Md

How To Scale A Real Estate Business What Do You Think About This Comment Be Real Estate Investing Rental Property Rental Property Investment Estate Investing

Real Estate A Safer Investment Option Post Covid Assetz

Tax Shelters Definition Types Examples Of Tax Shelter

Student Housing The Complete Guide College Life Nl

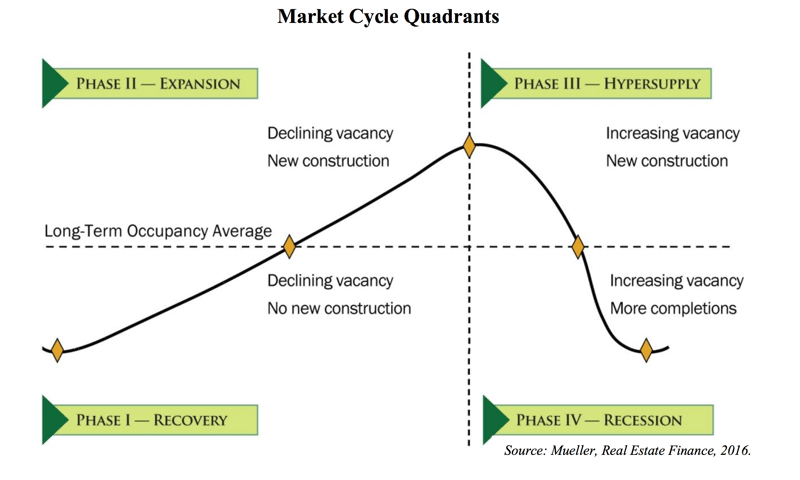

The Four Phases Of The Real Estate Cycle Crowdstreet

Fipedia Financial Independence Early Retirement Investing

Commercial Real Estate Tax Benefits And How To Take Advantage Of Them Pioneer Realty Capital

Hướng Dẫn Khach Hang Ca Nhan Lam Hồ Sơ Vay Vốn Ngan Hang Loan Lenders Hard Money Lenders Loans For Bad Credit

It Is Very Exciting We Are Building Our Newest Model Of The Living In Panama House The 1 Bedroom Version And It Is Go House Under Construction Panama House

They Replied Believe In The Lord Jesus And You Will Be Saved You And Your Household Acts 16 31 Niv Bible Home Buying Best Tax Software House Lift

:max_bytes(150000):strip_icc()/mortgage-real-estate-investing-guide-4222543-v1-b49c49405ee14779adb25d2879411414.png)